Depreciation tax savings formula

By using the formula for the straight-line method the annual depreciation is calculated as. Base value x days held 365 x 200 assets effective life If the item is worth 30000 and we plan to use it in the next 10 years the formula would be.

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round.

. Tax depreciation refers to the depreciation expenses of a business that is an allowable deduction by the IRS. For example if a company has an annual depreciation of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. The straight line method of depreciation will be used and the entire cost of the asset will be depreciated over 6 years.

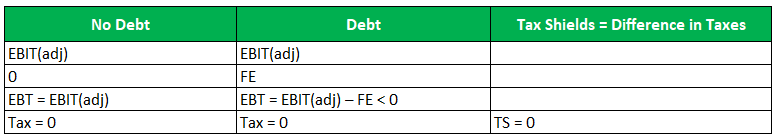

The recognition of depreciation causes a reduction to the pre-tax income or earnings before taxes EBT for each period thereby effectively creating a tax benefit. Remaining life of the asset Sum of the years digits x Cost of asset Scrap value of asset Depreciation expense. What Is the Tax Impact of Calculating Depreciation.

The tax rate of Marshal company is 30. Most often used for. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

35000 - 10000 5 5000. Depreciation is a method used to allocate the cost of tangible assets or fixed assets over an assets useful life. But with the depreciation write-off aka the number 1 write-off for real estate investors you now only have to pay tax on 6818.

This means the van depreciates at a rate of. Preset Value of the Tax Savings due to Depreciation The present value of the tax saving due to the tax allowance based on depreciation is given by the present value of. A declining or double-declining depreciation method is used to accelerate the depreciation expense for tax savings.

This means that by listing depreciation as an expense on. Assets that could become. A business will deduct depreciation expense from the total value of.

For depreciation an accelerated. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. Example Calculation Using the Section 179 Calculator.

This is derived from 25000 in rental. The formula is.

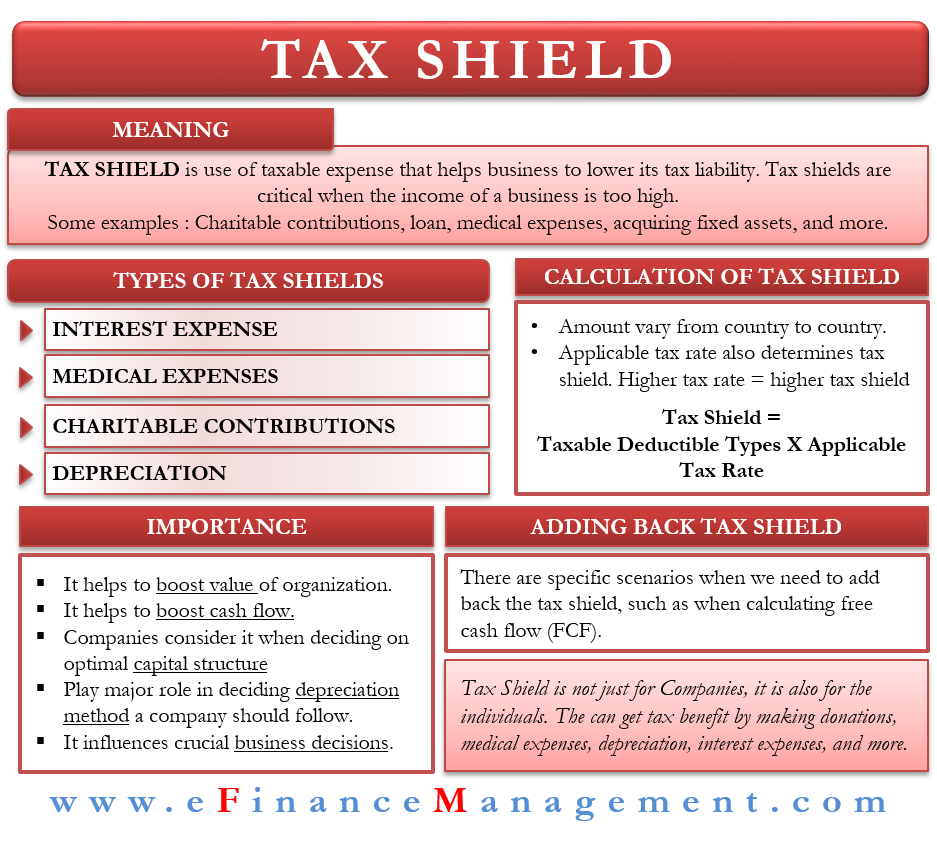

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Finance

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Meaning Importance Calculation And More

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Income Taxes In Capital Budgeting Decisions Chapter Ppt Download

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

What Is A Depreciation Tax Shield Universal Cpa Review