Roth ira conversion tax calculator

This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. Roth IRA Conversion Calculator to Calculate Retirement Comparisons.

Roth Ira Conversion Tax Calculator Software

For example if the taxpayer chose to convert a 10000 traditional IRA to a Roth IRA their new taxable income would be 60000 making their tax bill look like this.

. Use the calculator below to examine your own situation. This convert IRA to Roth calculator estimates the change in total net worth. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA.

Ad Discover if a Roth IRA conversion will work for your portfolio in 99 Retirement Tips. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. Calculate your earnings and more.

Ad Lets Partner For All Of Lifes Moments. The information in this tool includes education to help you determine if converting your. Roth IRA is a great way for clients to create tax-free income from their retirement assets.

This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account. A conversion has advantages and disadvantages that should be carefully considered before a decision is made. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will.

It is mainly intended for use by US. Please enter the following information Current age What age do you plan to retire. Once converted Roth IRA plans are not subject to required minimum distributions RMD.

Ad Visit Fidelity for Retirement Planning Education and Tools. Projected tax rate at retirement Assumed. While long-term savings in a Roth IRA may.

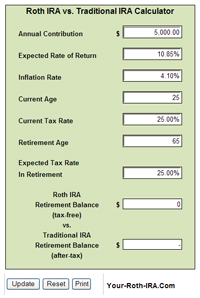

Reviews Trusted by Over 45000000. It increases your income and you pay. Use this Roth IRA conversion calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Financial Calculators Roth IRA conversion with distributions calculator Use this calculator to see how converting your traditional IRA to a Roth IRA could affect your net worth at retirement. Traditional IRA to Roth Conversion Calculator This calculator that will help you to compare the estimated consequences of keeping your Traditional IRA as is versus converting your.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your. Access Schwab Professionals 247.

New Look At Your Financial Strategy. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year.

Learn More About IRAs On Our Official Site. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will. The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment financial or tax planning decisions.

Get The Flexibility Visibility To Spend W Confidence. There are many factors to consider including the amount to convert current tax rate and your age. Converted plan balance is allowed to grow tax-free and all withdrawals are tax-free as well.

Buy Gold Investments from Top US Providers. Roth IRA is a great way for clients to create tax-free income from their retirement assets. Visit Edward Jones Now.

Call 866-855-5635 or open a Schwab IRA today. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

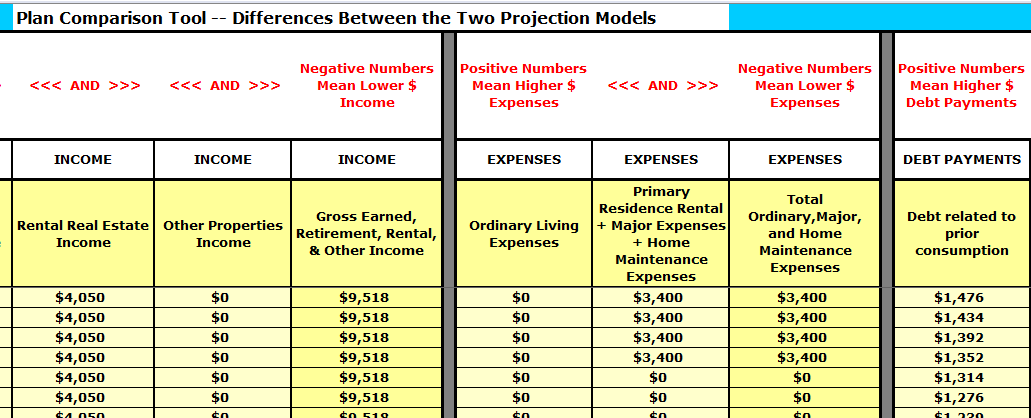

Ad Visit Fidelity for Retirement Planning Education and Tools. VeriPlans Roth IRA conversion tax calculator tool helps you to understand which years in the future might be better to do Roth conversions and it helps you to judge the. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

Read Tip 91 to learn more about Fisher Investments advice regarding IRA conversions. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. The decision to convert may rest on whether you are willing to pay the taxes now in return for potentially receiving more after-tax income when you withdraw money from the IRA later.

The calculator will estimate the monthly payout from your Roth IRA in retirement.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

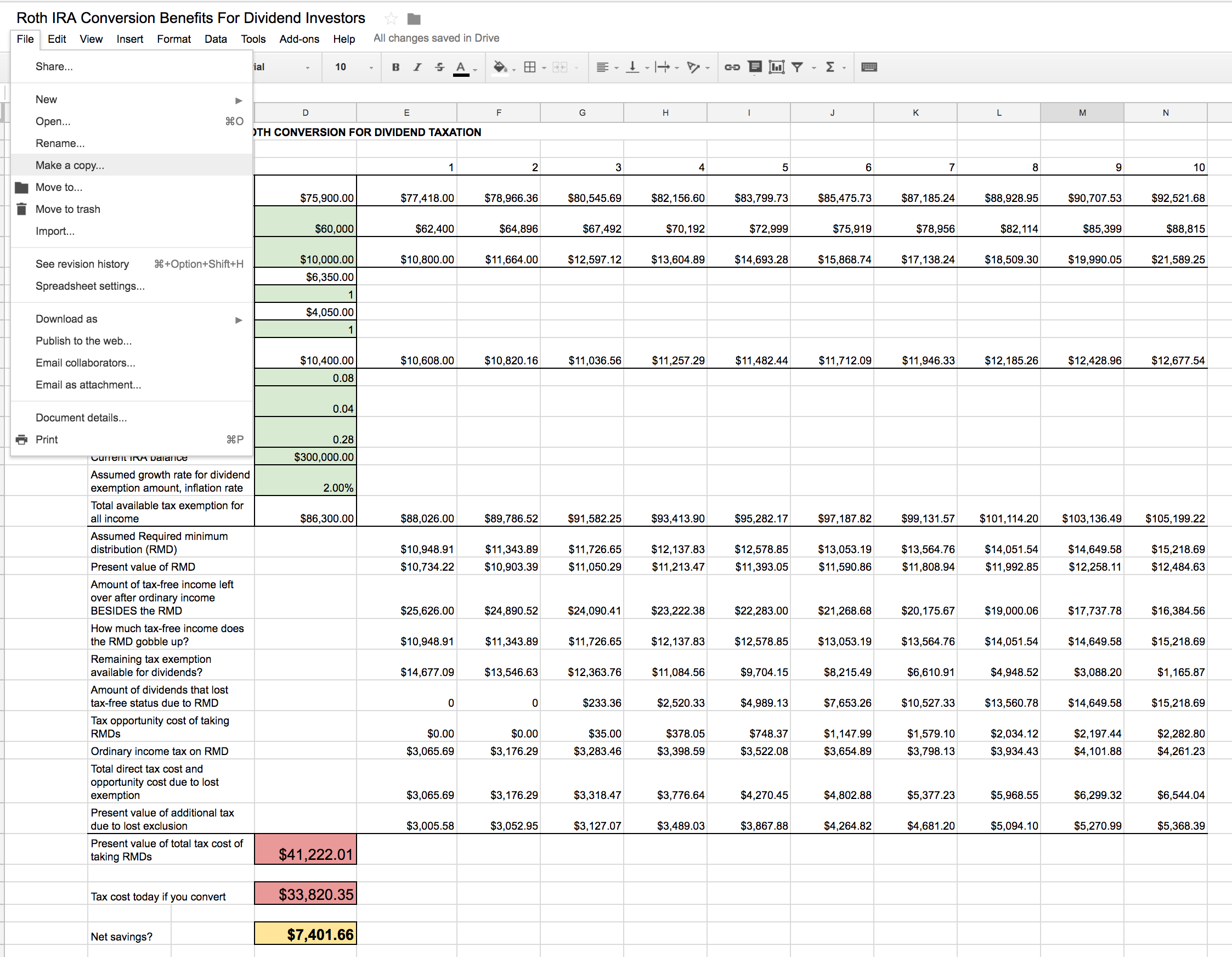

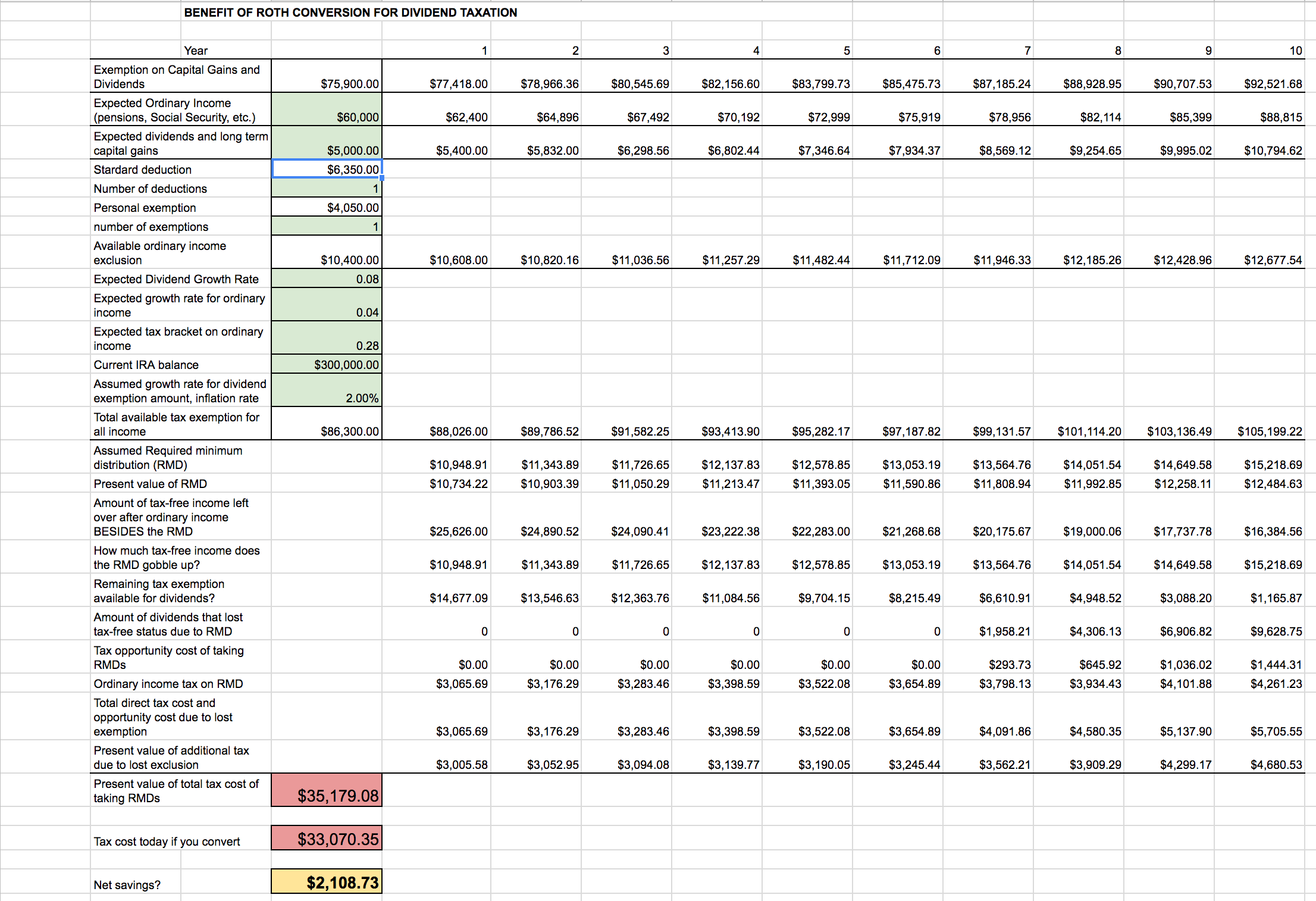

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Conversion 2012 Roth Calculator For Prof Low Income Marotta On Money

Traditional Vs Roth Ira Calculator

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Excel Template For Free

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Roth Ira Calculators

Diy Roth Conversion Engine Template Bogleheads Org

Systematic Partial Roth Conversions Recharacterizations

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Conversion Calculator Excel

Roth Ira Calculators

Roth Ira Conversion 2012 Roth Calculator For Mr Esq Marotta On Money

Traditional To Roth Ira Conversion Calculator Keep Or Convert

Systematic Partial Roth Conversions Recharacterizations

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal